Financial control across generations

As society evolves, new challenges emerge for everyday people. Paying bills while still maintaining some semblance of a work-life balance has become increasingly difficult and the consequences of this change are shaping the way an entire generation views financial independence and security.

How has this rapid change impacted generational finances and how does insufficient financial control affect younger generations? We surveyed more than 1,000 Australians and Americans in order to better understand the current state of finances across different age groups. If you are interested in learning about how financial control has ebbed and waned over the decades, this study is for you.

Find out more below.

Key takeaways

- Almost nine in 10 Millennials and Gen Zers had delayed at least one life milestone due to insufficient finances.

- Nearly half of Millennials said a lack of control over their finances had prevented them from buying a home.

- Millennials and Gen Zers were almost twice as likely as older generations to say income inequality was reducing their control over personal finances.

Perceptions of financial control

Finances are a regular concern for most people, but how do these concerns line up across different generations? This section of our study examined the sense of financial control felt across various age groups.

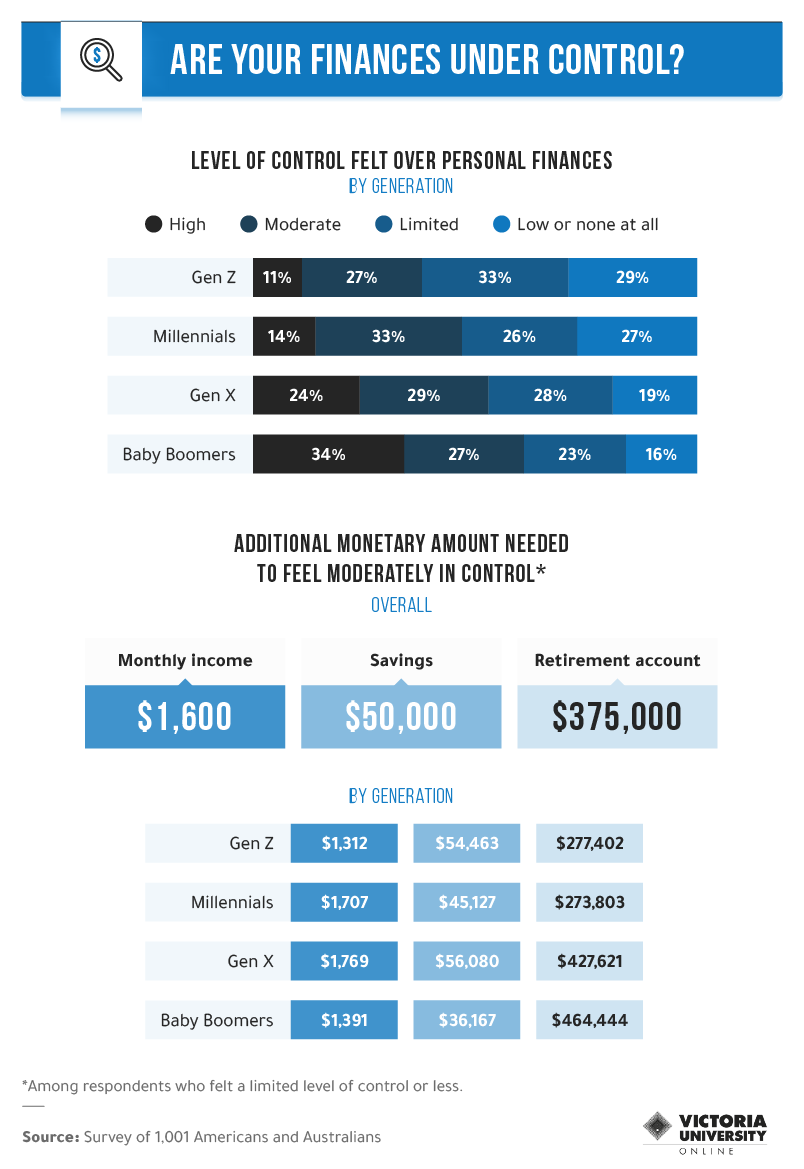

Level of Control Felt Over Personal Finances

Gen Z:

- High = 11 per cent

- Moderate = 27 per cent

- Limited = 33 per cent

- Low or none at all = 29 per cent

Millennials:

- High = 14 per cent

- Moderate = 33 per cent

- Limited = 26 per cent

- Low or none at all = 27 per cent

Gen X:

- High = 24 per cent

- Moderate = 29 per cent

- Limited = 28 per cent

- Low or none at all = 19 per cent

Baby Boomers

- High = 34 per cent

- Moderate = 27 per cent

- Limited = 23 per cent

- Low or none at all = 16 per cent

Additional monetary amount needed to feel moderately in control among respondents who felt a limited level of control or less.

- Monthly Income: $1,600

- Savings: $50,000

- Retirement account: $375,000

Additional monetary amount needed to feel moderately in control by generation.

Gen Z:

- Monthly Income: $1,312

- Savings: $54,463

- Retirement account: $277,40

Millennials

- Monthly Income: $1,707

- Savings: $45,127

- Retirement account: $273,803

Gen X:

- Monthly Income: $1,769

- Savings: $56,080

- Retirement account: $427,621

Baby Boomers:

- Monthly Income: $1,391

- Savings: $36,167

- Retirement account: $464,444

Our study showed that financial control is a significant problem for Millennials and Gen Zers, with almost half indicating that housing costs were a concern that impacted their financial security. This was in stark contrast to older generations, among whom less than one in four said the same. Only 14 per cent of Millennials felt they had a high level of control over their finances, while 27 per cent admitted they felt little or no control. Student loan debt and stagnant wages, for example, are common issues faced by Millennials. For Gen Zers, the challenge is less student loan debt and more paying everyday bills, especially during the upheaval of the pandemic.

These figures are distinctly worse than those for both Gen Xers and Baby Boomers. Among Baby Boomers, 34 per cent felt a high level of control over their personal finances, with just 16 per cent reporting little to no control over them. Meanwhile, 24 per cent of Gen Xers indicated their finances were highly under control, versus 19 per cent who reported little to no control.

We asked struggling respondents how much more money they would need to feel at least moderately in control of their finances. Overall, answers indicated that an extra $1,600 a month would improve financial security. Most respondents reported that an extra $50,000 in their savings account and at least $375,000 more in their retirement account would be ideal. These findings reflect a widespread difficulty saving money, with roughly 70 per cent of Millennials living paycheck to paycheck and about 65 per cent of Gen Zers reporting the same.

Of money and milestones

Another enlightening piece of information gleaned from our survey was the number of people delaying milestones because of financial concerns.

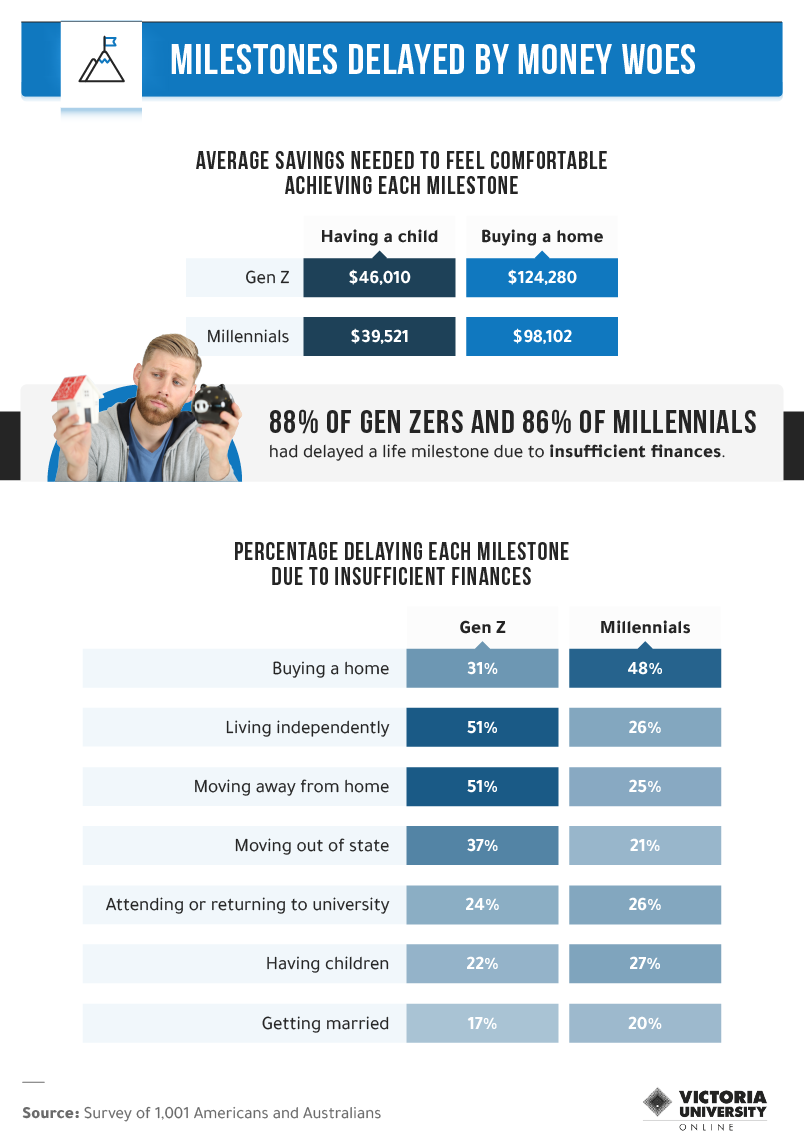

Milestones Delayed by Money Woes

Average savings needed to feel comfortable achieving each milestone

Having a child

- Gen Z: $46,010

- Millennials: $39,521

Buying a home

- Gen Z: $124,280

- Millennials: $98,102

88 per cent of GenZers and 86 per cent of Millennials had delayed a life milestone due to insufficient finances.

Percentage delayed each milestone due to insufficient finances

- Buying a home - Gen Z: 31 per cent, Millennials: 48 per cent

- Living independently - Gen Z: 51 per cent, Millennials: 26 per cent

- Moving away from home - Gen Z: 51 per cent, Millennials: 25 per cent

- Moving out of state - Gen Z: 37 per cent, Millennials: 21 per cent

- Attending or returning to university - Gen Z: 24 per cent, Millennials: 26 per cent

- Having children - Gen Z: 22 per cent, Millennials: 27 per cent

- Getting married - Gen Z: 17 per cent, Millennials: 20 per cent

While only 48 per cent of Boomers reported delaying milestones due to insufficient funds, 88 per cent of Gen Zers said the same. Just over half of our Generation Z respondents reported waiting to live independently and move away from home, compared to roughly 25 per cent of Millennials. Meanwhile, nearly half of our Millennial respondents reported having to delay buying their own home due to financial concerns, with more Millennials struggling to afford a home than any previous generation.

Having and raising children highlights another milestone missed by younger generations, with over a quarter of the Millennials in our study delaying starting a family due to financial insecurity. Nearly three out of five childless Millennials say that they do not have children because raising them is too expensive. While this concern existed before the pandemic, COVID-19-related uncertainty has only compounded this generation’s reluctance to have children.

Catalysts for losing control

That younger generations are experiencing increased financial insecurity and decreased feelings of financial control is clear, but what has led to this dramatic and troubling change?

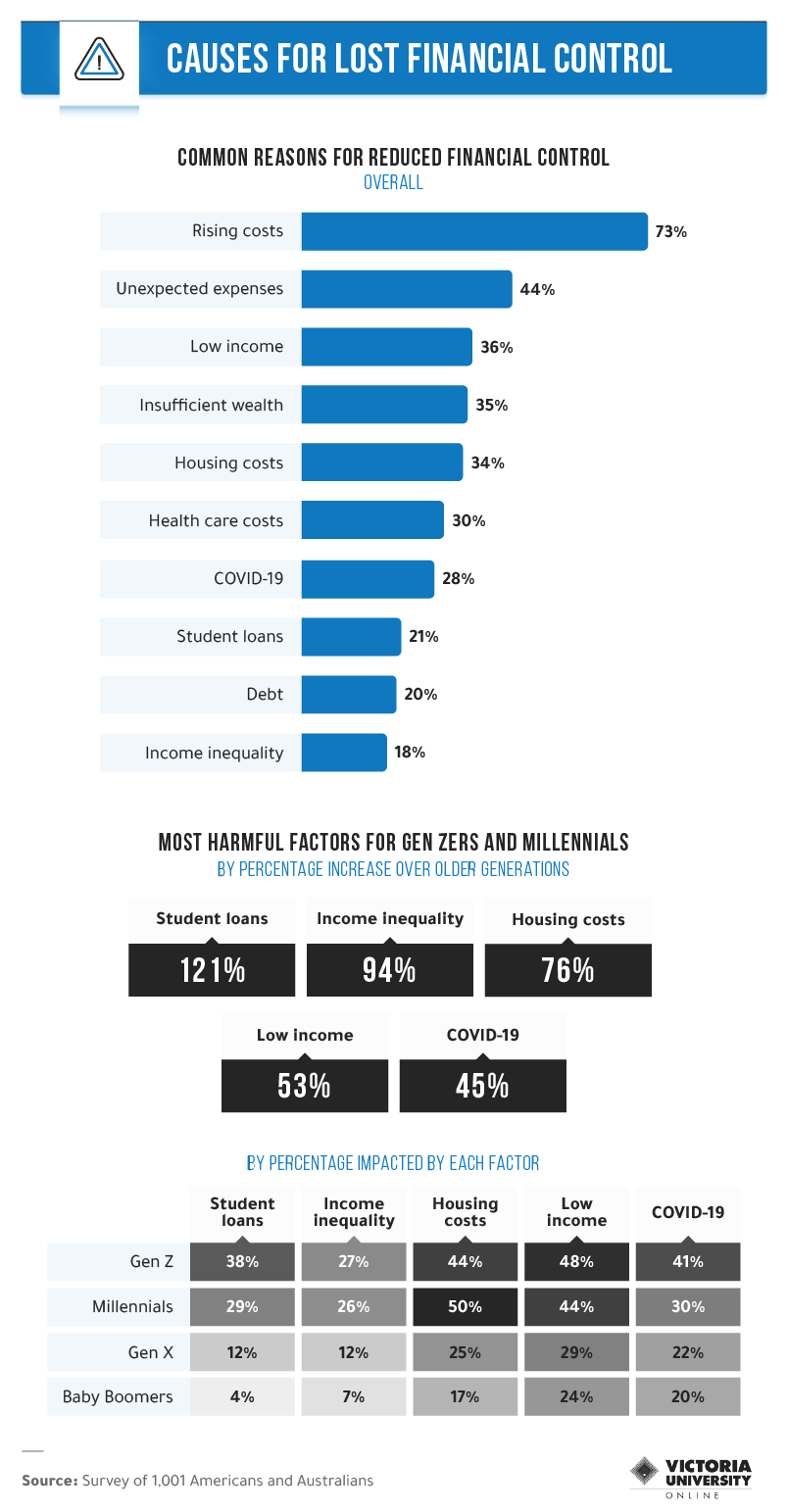

Causes for Lost Financial Control

Common reasons for Reduced Financial Control Overall

- Rising costs: 73 per cent

- Unexpected expenses: 44 per cent

- Low income: 36 per cent

- Insufficient wealth: 35 per cent

- Housing costs: 34 per cent

- Health care costs 30 per cent

- COVID-19: 28 per cent

- Student loads: 21 per cent

- Debt: 20 per cent

- Income inequality: 18 per cent

Most harmful factors for GenZers and Millennials by percentage increase over older generations

- Student loans: 121 per cent

- Income inequality: 94 per cent

- Housing costs: 76 per cent

- Low income: 53 per cent

- COVID-19: 45 per cent

- By Percentage Impacted by Each factor

- Gen Z - Student loans: 38 per cent, Income inequality: 27 per cent, Housing costs: 44 per cent, Low income: 48 per cent, COVID-19: 41 per cent

- Millennials - Student loans: 29 per cent, Income inequality: 26 per cent, Housing costs: 50 per cent, Low income: 44 per cent, COVID-19: 30 per cent

- Gen X - Student loans: 12 per cent, Income inequality: 12 per cent, Housing costs: 25 per cent, Low income: 29 per cent, COVID-19: 22 per cent

- Baby Boomers: Student loans: 4 per cent, Income inequality: 7 per cent, Housing costs: 17 per cent, Low income: 24 per cent, COVID-19: 20 per cent

Our survey found that overall, the number one factor causing a feeling of reduced financial control among our respondents was the rising cost of living. Seventy-three per cent of our respondents indicated this as the reason for their concern, compared with 44 per cent who indicated unexpected expenses, the next highest response.

The numbers above do not tell the whole story, however, as the situation becomes even more striking when compared across generations. Younger generations reported a 121 per cent increase over Gen X and Baby Boomer respondents when it came to student loan concerns; a 94 per cent increase for income inequality concerns; 76 per cent for housing costs; 53 per cent for low income; and 45 per cent for COVID-19-related concerns.

The rising costs of education and housing along with the difficulty of finding well-paying jobs were therefore some of the most harmful factors to Millennial and Gen Zer feelings of financial control.

Going for growth

While not all of the issues discussed above are easily fixable, there are a few ways in which people across all generations can improve their financial situation.

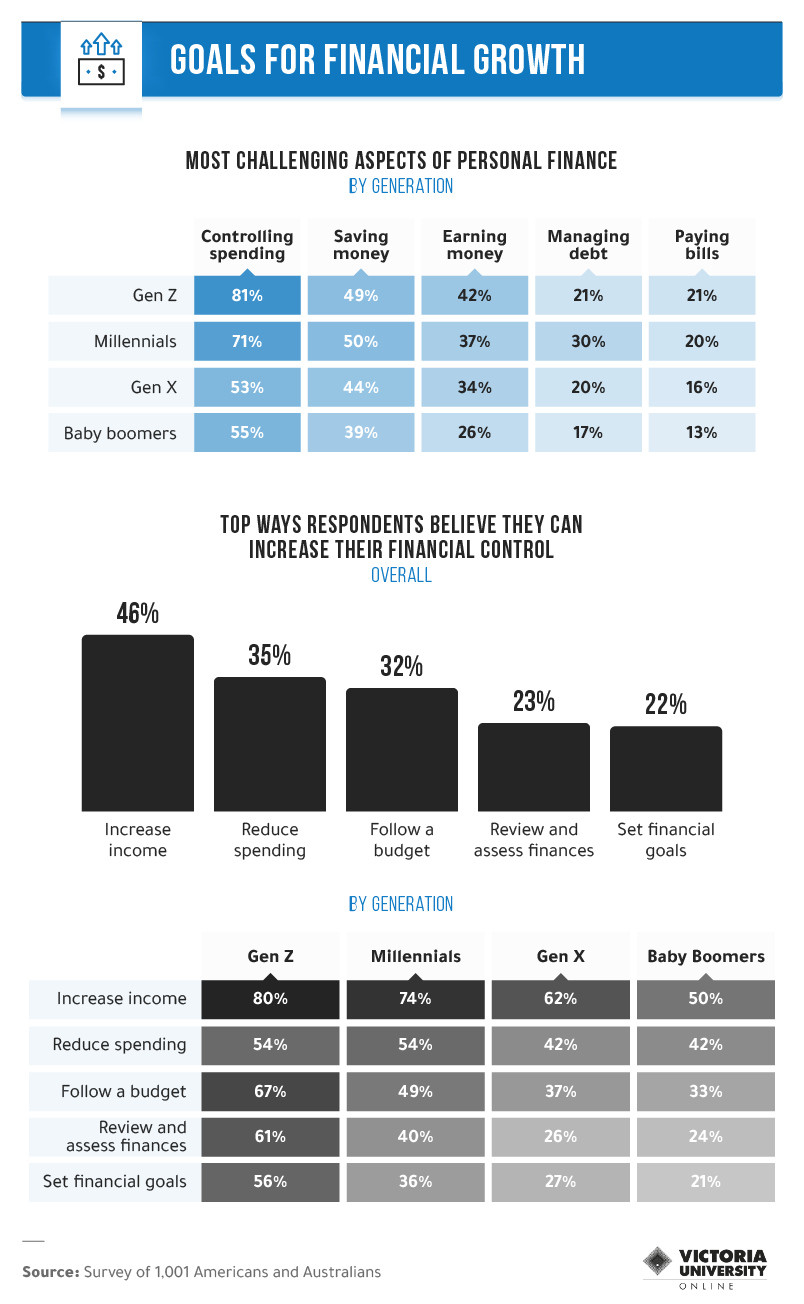

Goals for Financial Growth

Most challenging aspects of personal finance by generation

Gen Z

- Controlling spending: 81 per cent

- Saving money: 49 per cent

- Earning money: 42 per cent

- Managing debt: 21 per cent

- Paying bills: 21 per cent

Millennials

- Controlling spending: 71 per cent

- Saving money: 50 per cent

- Earning money: 37 per cent

- Managing debt: 30 per cent

- Paying bills: 20 per cent

Gen X

- Controlling spending: 53 per cent

- Saving money: 44 per cent

- Earning money: 34 per cent

- Managing debt: 20 per cent

- Paying bills: 16 per cent

Baby Boomers

- Controlling spending: 55 per cent

- Saving money: 39 per cent

- Earning money: 26 per cent

- Managing debt: 17 per cent

- Paying bills: 13 per cent

Top ways respondents believe they can increase their financial control overall

- Increase income: 46 per cent

- Reduce spending: 35 per cent

- Follow a budget: 32 per cent

- Review and assess finances: 23 per cent

- Set financial goals: 22 per cent

By generation

Gen Z

- Increase income: 80 per cent

- Reduce spending: 54 per cent

- Follow a budget: 67 per cent

- Review and assess finances: 61 per cent

- Set financial goals: 56 per cent

Millennials

- Increase income: 74 per cent

- Reduce spending: 54 per cent

- Follow a budget: 49 per cent

- Review and assess finances: 40 per cent

- Set financial goals: 36 per cent

Gen X

- Increase income: 62 per cent

- Reduce spending: 42 per cent

- Follow a budget: 37 per cent

- Review and assess finances: 26 per cent

- Set financial goals: 27 per cent

Baby Boomers

- Increase income: 50 per cent

- Reduce spending: 42 per cent

- Follow a budget: 33 per cent

- Review and assess finances: 24 per cent

- Set financial goals: 21 per cent

Controlling spending was the top challenge for all of the generations surveyed. Eighty-one per cent of Gen Zers, 71 per cent of Millennials, 53 per cent of Gen Xers and 55 per cent of Boomers found it challenging to keep their spending under control. Saving money was the second most significant challenge for all age groups.

Earning money, managing debt and paying bills were all challenges that affected different generations to a varying degree. Eighty per cent of Gen Zers reported that earning more money would improve their financial control, compared to just 62 per cent Gen Xers and 50 per cent of Boomers. This explains why many Millennials and Gen Z workers are seeking careers and employers that respect their employees by paying a livable wage.

Interestingly, while Millennials were the most concerned of all generations about managing debt (30 per cent), Gen Zers were more in line with Gen Xers and Boomers on this topic. Roughly 20 per cent of respondents across these three generations found debt management to be a challenge.

Concern about paying bills grew steadily as the generations got younger. These worries reflect the increased price of essential items such as housing, utilities, food and petrol, which has increased by nearly 8 per cent over the past 12 months.

When asked which basic financial health tools could help improve their financial control, we found that Gen Zers showed the highest level of confidence in each of the actions suggested. Sixty-seven per cent thought following a budget would improve their financial situation; 61 per cent believed reviewing and assessing finances would be beneficial; and 56 per cent reported faith in setting financial goals.

Taking back financial control

We found the results of our study to be concerning, but not surprising. They reinforced the findings about generational financial wellness and control that have become a common topic of discussion in mainstream media. A rapidly changing world shaped by the unprecedented effects of the COVID-19 pandemic has led to an increasingly untenable financial situation for Millennials and Gen Zers in particular, especially as the cost of living continues to rise.

Plan for success with VU Online’s Master of Financial Planning

Everyone needs a financial plan. For some, it’s to achievethe dreams of tomorrow. For others, it’s to make the mostof what they’ve got, today.

Trusted financial planners are essential for advice and support through the good times—and the bad—to ensure that a client’s hard earned money works even harder than they do.

Gain the advanced skills and necessary qualifications you need to help clients achieve financial security and success with our 100% online Master of Financial Planning. Find out more by reaching out to our Student Enrolment Advisors on 1300 682 051 or email futurestudy@online.vu.edu.au.

Methodology and limitations

We surveyed 1,001 people from Australia and the United States to explore the sense of financial control felt across age groups ranging from Gen Zers to baby boomers. The number of respondents was fairly equally distributed across the four generations of focus in our study: Gen Zers (218), millennials (292), Gen Xers (249) and baby boomers (238) as well as four respondents from the silent generation. Among these 1,001 respondents, 283 were women, 701 were men and 17 reported as nonconforming or nonbinary.

Our study relied on self-reporting with associated concerns, including selective memory, exaggeration and telescoping.

We removed outliers from short, open-ended questions and required our participants to identify and complete an attention-check question.

Fair use statement

Looking to help others improve their financial control? Feel free to share this study, as long as it’s for noncommercial purposes and a link back to this page is provided.