Developing finance skills: Key tips and resources

Money makes the world go round, the saying goes. That’s why jobs in banking and finance are so plentiful. In Australia, jobs in banking and finance are up by 45 per cent this year alone. Not only are banking and finance roles plentiful, they are also well paid, ranking among the most rewarding in Australia.

This is why working in the finance industry is a desirable career for many people. To make the most of opportunities in finance and banking, professionals need to devote themselves to developing key finance skills.

If you are looking to pursue a finance career, we outline the skills you need to succeed in this rewarding industry. To develop your expertise and to take your career to the next level, VU Online’s MBA (Finance) will empower you with the financial skills demanded of today’s business leaders.

What are finance skills?

Skills required for finance jobs are a broad range of hard and soft skills. They can be applied to roles in the finance industry, including finance managers, financial analysts, underwriters, chief financial officers and accountants.

Each position and level of seniority will call for different finance skills, but all finance professionals need a number of core skills.

These core skills will be explored in more detail below. When utilised together, they enable professionals to uphold financial practices and help a business maintain a solid financial standing.

Moreover, these skills enable professionals to manage otherwise unpredictable financial situations and solve financial problems in a way that benefits the business they work for. Typically, these skills are acquired through formal study as well as through professional experience.

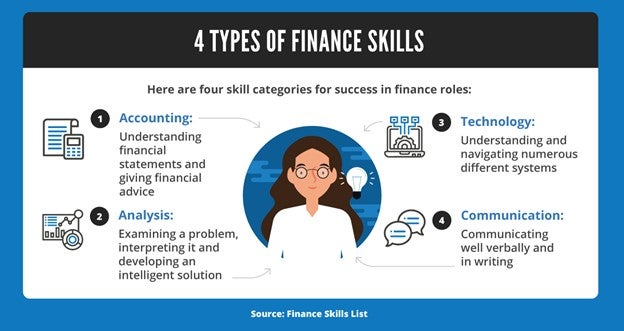

Types of finance skills

The broader list of finance skills can be grouped into four categories. Each of these skill categories focuses on a different aspect of finance jobs and each is required for almost every type of finance role.

1. Accounting

Accounting skills encompass a finance professional’s ability to accurately and ethically manage financial transactions, including analysing financial data and generating financial reports. To acquire accounting skills, finance professionals typically seek a formal financial education that teaches accounting principles, focusing on mathematics and data analyses.

As accounting is a heavily regulated profession, accounting finance skills also include the ability to understand current regulations and put them into practice.

Depending on your finance role, you may or may not be preparing financial statements and working with budgets. However, at the very least, finance professionals must have the ability to read and discuss financial statements, and in some circumstances, give financial advice.

Potential finance skills associated with accounting include:

- Putting into practice accounting principles, standards and techniques.

- Understanding how to create a budget and manage cash flow.

- Understanding and managing financial data.

- Knowing how to reconcile financial statements and transactions.

- Performing a cost analysis and completing cost reduction activities.

2. Analysis

The skills for finance jobs go far beyond simply working with numbers. Employers expect finance professionals to make sense of financial data and translate it into something useful for the business. For this reason, analysing financial information is the second essential category of finance skills.

Financial analysis skills include the ability to:

- Examine financial data.

- Apply data to business goals.

- Interpret data to inform financial decisions.

On a practical level, analysis finance skills involve the ability both to perform general data analysis and to use technology to do so. This allows professionals to solve financial problems.

Potential finance skills associated with analysis include:

- Analysing data and making sound financial decisions as a result.

- Undertaking financial analysis and planning.

- Making forecasts and predictions based on business and financial data.

- Understanding how a business functions more broadly and incorporating this information into financial planning.

- General problem-solving skills.

3. Technology

Given the wealth of finance technology tools available today, a critical finance skill is the ability to harness this technology to help collect, understand and make sense of financial data.

When it comes to finance, there is almost no limit to how much assistance technology can provide. Financial technology helps finance professionals discover, sort and process vast amounts of information, and it replaces what was previously time-consuming and menial work.

Because financial technology is constantly changing and evolving, finance professionals need solid technological skills to keep up to date with the latest industry developments.

Potential finance skills associated with the technology category include:

- Having financial engineering and modelling skills.

- Using accounting software, including Xero and Quickbooks.

- Applying all aspects of financial transaction recording and analysis.

- Using financial technology to solve problems and provide business outcomes.

4. Communication

Given that working in the financial sector requires a high level of trust and many people have a stake in the results, an essential skill for finance jobs is effective communication.

Trustworthy and effective communication has many elements. Finance professionals need to:

- Communicate without jargon.

- Explain detailed concepts simply.

- Communicate with integrity.

Potential finance skills associated with communication include:

- Simply and effectively communicating financial advice and reports.

- Understanding verbal and non-verbal communication techniques.

- Understanding how to inspire and engender trust and confidence.

- Knowing how to best manage relationships with different stakeholders.

- Knowing how to communicate verbally and in written form, including via presentations.

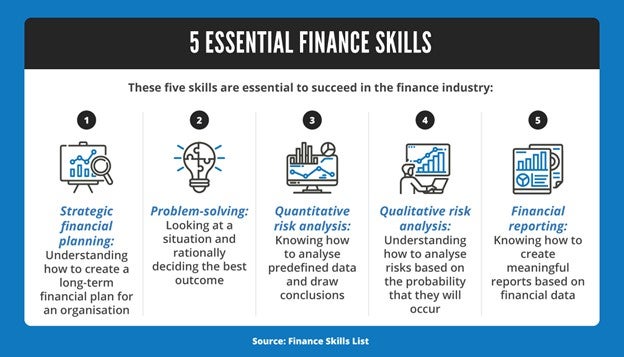

5 essential finance skills with examples

These essential finance skills will, at some stage, be used by almost all finance professionals. They are critical in ensuring that a business’ financial problems are addressed and that financial data is translated into meaningful information for the organisation.

Here are the five essential finance skills, as well as an example of each skill in action and a brief description of how to improve each skill.

1. Analytical thinking

Analytical thinking means collecting and analysing financial information, and solving problems based on your conclusions. Analytical skills include:

- Detecting patterns

- Observing, collecting and interpreting data

- Integrating and synthesising information

- Making decisions.

An example of analytical thinking in finance would be running different financial reports that expose new costs that may not have previously been identified by the business.

You can improve your analytical thinking skills by analysing mock data sets and trying to draw new conclusions.

2. Problem-solving

Problem-solving is:

- Identifying a problem

- Generating possible solutions

- Evaluating the alternatives

- Deciding on a solution

- Implementing solutions.

Basically, it means understanding the issues that might be plaguing the business you are working for and using creativity and ingenuity to devise solutions. An example of problem-solving skills in finance would be recognising why a business is continuing to show a loss, despite otherwise healthy financials. To improve your problem-solving skills, practice finding creative and out-of-the-box solutions to problems.

3. Strategic financial planning

Strategic financial planning is the process of determining how a business will manage its finances and ensuring that it achieves its financial goals in the long- and short-term.

An example of strategic financial planning would be to create profit and loss forecasts for the year ahead and evaluate how core financial metrics can be improved.

To improve upon your strategic financial planning skills, develop shorter planning cycles so you can work with the most up-to-date data.

4. Quantitative risk analysis

Quantitative risk analysis is a risk analysis technique that assigns a numeric estimate to the overall effect of a certain risk on a particular objective. This type of analysis provides insight into the potential financial impact of a certain risk event. It is usually used to create a plan to mitigate that particular risk and its impacts.

An example of how financial professionals use quantitative risk analysis is estimating future insurance premiums based on the risk of certain events occuring.

To improve your quantitative risk analysis skills, you can regularly conduct an in-depth review of your risk analysis process.

5. Qualitative risk analysis

The qualitative risk analysis technique involves creating a written definition of a risk, then providing an evaluation of the extent of the impact of that risk, as well as supplying detail on risk mitigation strategies you can put in place.

An example of how financial professionals use qualitative risk analysis is analysing a company’s value based on assets that cannot be quantified, such as the strength of its leadership or culture.

In order to improve your skills in this area, strive to understand the probability and impact of potential risks facing your business in more detail.

Top finance skills by job type

Although all financial roles require many finance skills, the particular finance skills needed for a given job can vary. Here are the five top roles in finance, plus a list of the top five skills required for each role:

1. Finance manager

The finance skills required for a finance manager include:

- Cash versus accrual accounting: Understanding cash accounting (the method of accounting that records a sale when the money is made) as well as accrual accounting (in which a transaction is recorded when it’s made, not when the money is actually received).

- Financial statement management: Understanding basic financial statements and how to use those statements to improve financial operational performance.

- Variance analysis: Analysing variances in budgets and understanding why they occurred.

- Strategic financial analysis: Analysing financial information and creating strategies to increase cash flow.

- Budget preparation: Understanding how to create a budget, using objectives and action plans.

2. Financial analyst

The finance skills required for a financial analyst include:

- Financial forecasting: Understanding how to use operational financial information to forecast future financial trends and understand risks.

- Financial modelling: Understanding how to use financial data to create potential future scenarios.

- Financial reporting: Creating a variety of reports that clearly and simply display a company’s financial position.

- Variance analysis: Analysing variances in budgets and understanding why they occurred.

- Cost analysis: Analysing costs versus benefits for a variety of financial situations.

3. Accountant

The finance skills required for an accountant include:

- General business knowledge: Understanding how a business operates and makes a profit.

- Knowledge of accounting principles: Understanding all the core accounting principles required to create financial reports.

- Technology expertise: Understanding how accounting technology works, including accounting software, cloud computing applications and automated systems.

- Financial statement management: Understanding basic financial statements and how to use those statements to improve financial operational performance.

- Data analysis: Knowing how to compile and analyse raw data, and identify patterns in data sets.

4. Personal finance adviser

The finance skills required for a personal finance adviser include:

- Wealth management: Knowing how to help clients achieve and maintain wealth.

- Research: Knowing how to research a client’s financial history and analyse their money management.

- Business development: Understanding how to attract and discover new clients.

- Client relationship management: Effectively communicating with and managing a wide range of clients.

- Risk assessment: Analysing financial risk and recommending the most suitable products.

Interested in becoming a financial adviser? Our Master of Financial Planning can give you the skills and expertise needed to thrive in this role.

5. Management analyst

The finance skills required for a management analyst include:

- Strategic financial analysis: Analysing financial information and creating strategies to increase cash flow.

- Critical thinking skills: Analysing a situation and developing an effective solution.

- Compliance: Understanding and putting into practice relevant regulatory requirements.

- Financial reporting: Creating reports that clearly display a company’s financial position.

- Technology expertise: Knowing how finance technology works, including software, cloud computing applications and automated systems.

How to make finance skills stand out on your CV

Once you develop an impressive set of finance skills, you will want to ensure they stand out on your CV. For your next big career move into a finance role, here’s how to highlight the top five finance skills on your CV:

1. Analytical thinking

To show this important finance skill on your CV, give examples of how you have used financial information to solve real-world problems.

Also make sure to mention where you’ve achieved (or overachieved) on your key performance indicator (KPI) results.

2. Problem-solving

Problem-solving is essential in all finance roles and may take many forms, depending on your job type. It may be as simple as removing an unnecessary process, or as complex as addressing the financial implications of a new business structure.

When highlighting an example of your problem-solving abilities on your finance CV, explain the financial benefit the business derived from your solution.

3. Strategic financial planning

Employers want finance professionals who can go beyond the numbers and provide strategic insights into how to manage the organisation’s finances in the future.

An example of strategic financial planning on a finance CV is how you used financial reports to create predictions and project trends for future years.

4. Quantitative risk analysis

Quantitative risk analysis is a finance skill often used in estimating risks, costs and payouts for certain events.

An example of quantitative risk analysis to include on a finance CV would be how you calculated accurate premiums for certain risks and ensured payouts while remaining profitable.

5. Qualitative risk analysis

Professionals often use the qualitative analysis finance skill when analysing risks that may not be tangible or finite.

An example of a qualitative risk analysis to include on a CV is a strengths, weaknesses, opportunities and threats (SWOT) analysis you created, including financial implications, for a new business structure.

Additional resources for writing a finance CV

For more information on how to write a finance CV, refer to:

- CV Expert, Finance Manager Resume Sample

- LiveCareer, Finance Resume Examples

- StandOut CV, Finance CV Examples

- Zety, Finance Resume Examples and Writing Guide for 2022

Finance skills: A way to futureproof your career

If you want to expand your career opportunities and become a financial manager or leader, building your finance skills is crucial. With VU Online’s MBA (Finance) you will study four core areas of finance that will give you the expertise required to succeed in these roles.

Want to know more? Reach out to our Student Enrolment Advisors on 1300 682 051 or email futurestudy@online.vu.edu.au.